Last year, in May 2021, I undertook a similar analysis to understand the key investment trends of the Indian ESG mutual funds. While it is only a mere 7-8 months, I felt it would be interesting to see how the industry landscape has progressed and whether the portfolio composition or investment pattern of the funds have undergone changes.

As per the recent Edelweiss report the AUM of the India ESG focused mutual funds has expanded 4.7 times in the last 2 years (from November 2019). While this may reflect a substantial growth, it is pertinent to highlight that the initial base itself was very low. Two years ago, we had only 2 ESG funds and most of the ESG funds have been launched in these last 2 years itself. Further, this AUM (under ESG) still represents only a mere 0.3% of the total mutual funds in India (Nov 2021). Further, India still lags behind the global pool. Canada has the highest proportion of sustainable investment assets at 62% of the total mutual fund AUMs, followed by Europe at 42%, Australia at 38%, the US with 33% and Japan at 24%[1]. With the projected growth in ESG assets (Bloomberg predicts that ESG assets may hit $53 trillion by 2025, representing a third of global AUM[2]) ESG fund growth in India can only move northward.

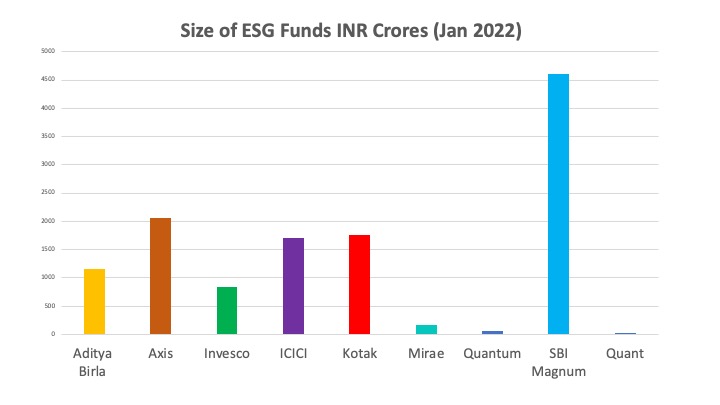

While several reports identify 10 ESG funds in India to date (one report indicates 23), my current analysis is based on a review of 9 of these ESG funds. The AUM of these 9 funds correspond to a size of ~ INR 12400 Crores.

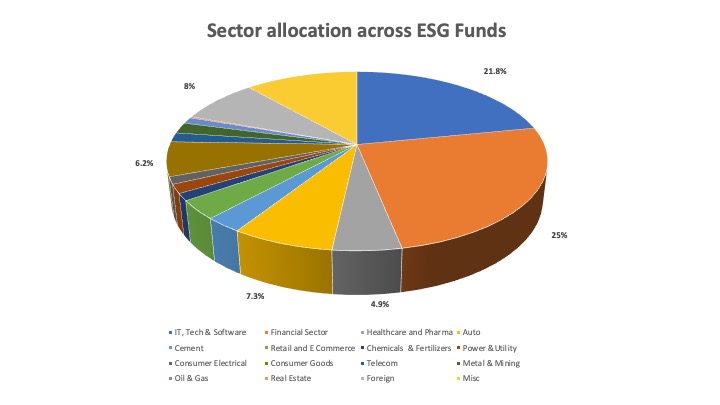

Sector Allocation

There has been no significant change from my last analysis in May 2021 as far as the top pick of sectors by these funds is concerned. IT, tech & software, and Financial services continue to dominate, attracting almost half of all the investments. The next 3 favorite sectors for these ESG funds also continue to remain the same viz., Auto, Consumer Goods, Health care & Pharma. This analysis is based on all the 9 funds collectively and it is possible that the spread across individual funds may however be different.

This could potentially be reflective of a passive outlook by the ESG investment managers as there appears to be a loading of large cap in the ESG funds. It is important that the sector selection should not be skewed towards only a market capitalization criterion but also consider the objective of the ESG funds

Most funds have a low exposure to Oil & Gas and Metal & Mining sectors. While 6 funds have exposure to Oil & Gas, only 3 funds have an exposure to Metal & Mining.

Commonality of the companies across the ESG funds

There are a total of 183 Indian companies who find their inclusion across the 9 funds. 3 of the funds have exposure to foreign investments and those investments total to about 8% of the overall investment. In the below analysis, the foreign investments have not been considered. No single company is a constituent in all 9 funds. 2 companies were common across 8 funds – HDFC Bank and Tata Consultancy Services. 60% of the companies (108) are unique to one fund. This was the same trend observed in my earlier analysis.

| Number of Common Companies | |

| 8 Funds | 2 |

| 7 Funds | 5 |

| 6 Funds | 2 |

| 5 Funds | 5 |

| 4 Funds | 2 |

| 3 Funds | 14 |

| 2 Funds | 45 |

Since there is commonality of sector orientation among funds, as a corollary, I expected more common constituents across the funds. Additionally, inclusion of some companies as part of the ESG fund portfolio were surprising, but I am sure the fund managers have their methodologies to support the inclusion of constituents in the fund. The new proposal from SEBI that the AMC’s should only invest in securities with BRSR disclosures is a welcome move as this will bring in more transparency with regards to the rationale of inclusion.

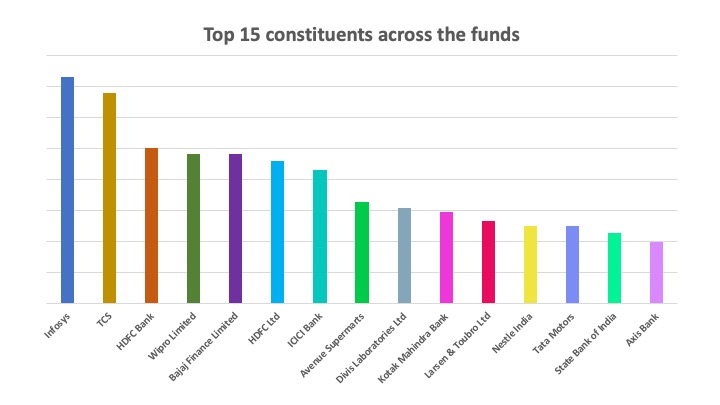

Top 15 investments

The top 15 investments comprise ~ 47.4% of the overall fund size. The investment in the rest 213 companies (incl International) is 52.6%.

As the ESG market grows, I am sure that the companies will take note of the same and will be more eager to be part of these funds. For the companies already included in these funds, it’s the proof in the pudding as the market is giving them a thumbs-up for their ESG performance.

For the ESG fund managers, there is a big potential to be more purposeful and innovative. They also have to be more active in their engagement with the companies around ESG topics.

The proxy advisory firms in India also need to become more active in the ESG space to contribute towards a more meaningful and mature ESG market in India.

Note: The constituents can change in the funds. This analysis was done with the constituents in each fund as of second week of January 2022 as per information available at moneycontrol.com.

[1] https://economictimes.indiatimes.com/mf/mf-news/esg-fund-assets-jump-4-7-times-in-2-years-may-grow-further/articleshow/88380627.cms

[2] https://www.bloomberg.com/professional/blog/esg-assets-may-hit-53-trillion-by-2025-a-third-of-global-aum/