We seem to be living in exciting times as the world is positioned for significant shifts, be it economic, technological or even demographical. As the globalized world shrinks, the corporate space will need to gird up for the future. Organizations will have to re-invent themselves more than ever to be profitable, attract talent or be sustainable.

And one of the primary ways in which organizations can be sustainable is through the adoption of research and development or what is popularly known as R&D.

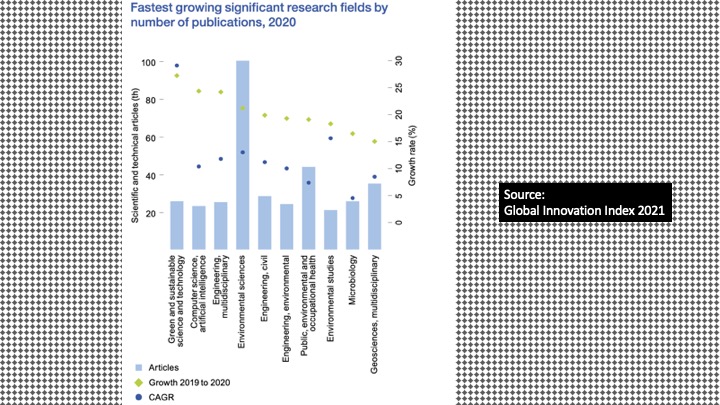

The Global Innovation Index 2021 puts “environment” as the fastest-growing research field[1]. The changing dimensions in the race to a sustainable world provide an equal opportunity for businesses worldwide. The race is paced well; no one is way ahead at this point[2].

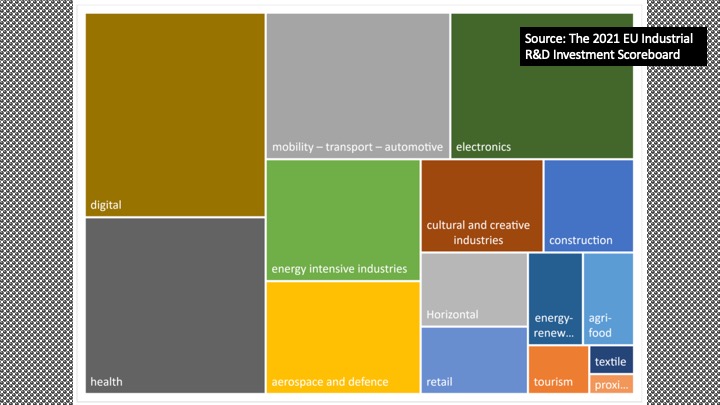

The 2021 EU Industrial R&D Investment Scoreboard, which analyses 2500 companies across 39 countries, is one of the most comprehensive databases available in the public[3]. It shows that the sectors with the fastest growth in R&D are ICT, Healthcare and Automobile.

Trivia: Amazon spent $42.74 billion in the fiscal 2020 (11.1% of net sales) on R&D.

How is India Inc positioned?

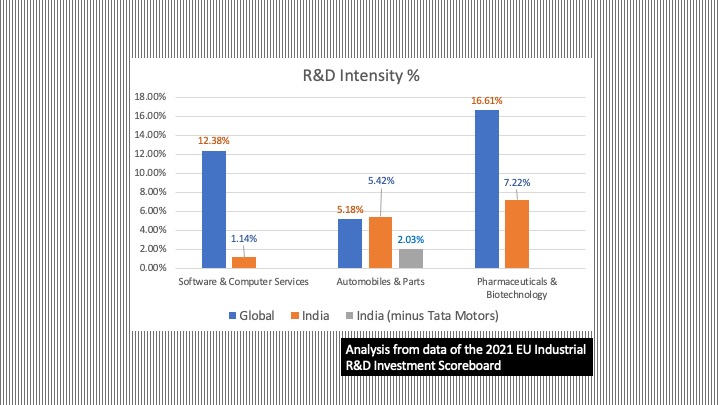

Tata Motors is the only company from India that falls into the top 100 ranks of the 2021 EU Industrial R&D Investment Scoreboard (Rank 79). The next ranking of an Indian company is 581, and the last ranking for an Indian company in the list of 2500 is 2471. R&D Intensity is a ratio that can be used to compare Indian companies with global peers. It is a ratio of R&D spending over net sales represented as a percentage. While the global average of the Software and Computer Services R&D Intensity was 12.38%, for the Indian peers, it was a meagre 1.14%. For the Pharmaceuticals and Biotechnology space, compared to the global ratio of 16.61%, the Indian peer ratio was only 7.22%. While in the Automobile segment, the Indian companies’ ratio was more than the global average, but it was mainly due to the contribution of Tata Motors. If we remove the contribution of Tata Motors, the other Indian companies’ average was 2.03% compared to the global average of 5.18%.

Among Indian companies, Tata Motors leads the Automobile companies in terms of R&D Intensity, For the Pharmaceuticals segment, the leader was Glenmark, and for Software and Computer Companies, it was HCL Technologies.

What could be the implications that one can draw from these rankings? It points towards the fact that traditionally Indian companies seem to be a bit of a laggard when it comes to R&D. One of the reasons that are regularly propounded is that finance is the challenge. But the EU Industrial List dismisses that argument, as it compares the R&D spend as a ratio to the net sales. Hence, the argument in terms of funding seems to be a tough one to bite.

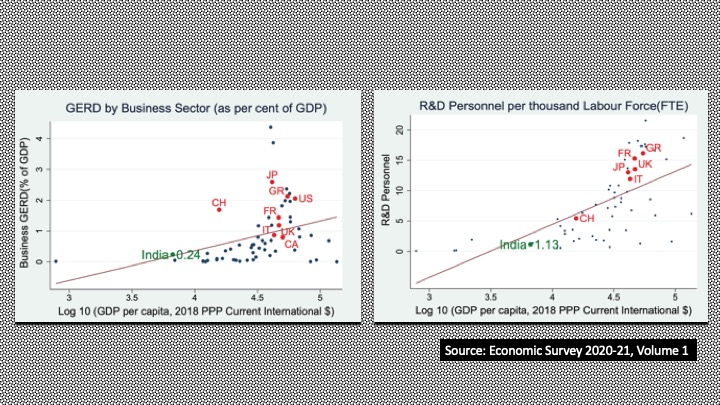

But when we seem to lack full-fledged investment, we tend to make it up with Jugaad. The term “Jugaad” stands for frugal innovation in India, which has catapaulted into a mainstream business terminology. While it is great to talk about how Indian companies can make do with little investment, it has its limitations. As the Economic Survey of India of 2020-21 puts it, “Mere reliance on ‘jugaad innovation’ risks missing the crucial opportunity to innovate our way into the future. This requires a major thrust on R&D by the business sector” [4].

Corporate India’s R&D expenditure can also account for “Jugaad”, as it has been frugal over the years compared to global peers. One of the survey’s measurements is GERD (Gross Domestic Expenditure on Research & Development). The survey states, “India’s gross domestic expenditure on R&D (GERD) is lowest amongst other largest economies. The government sector contributes a disproportionately large share in total GERD at three times the average of other largest economies. However, the business sector’s contribution to GERD is amongst the lowest. The business sector’s contribution to total R&D personnel and researchers also lags behind other large economies. This situation has prevailed even though the tax incentives for innovation have been more liberal than other economies. India’s innovation ranking is much lower than expected for its level of access to equity capital. This points towards the need for India’s business sector to significantly ramp up R&D investments” [5].

The hard fact is that Indian companies are not investing in R&D, which can be an Achilles heel for the industry. It is a loud shout to the top and the boards of companies. If the board is guiding the company towards long term sustainability, they should be asking the company about its investment in R&D and what are the outcomes. Indian boards and CEOs need to keep it as one of their evaluation criteria. And it is essential to understand that R&D investment should not be ad hoc, changing from year to year based on profits or sales. There needs to be a sweeping change in terms of looking at the investment and the ecosystem.

The Global Innovation Index (GII) gives a detailed chart of the performance of India. Some of the areas identified as our weaknesses to create an innovative ecosystem are Education, Ecological Sustainability, ICT access and usage and Gender Diversity. For the Indian companies, this should provide the right impetus to invest in innovation. They should aim to improve the knowledge and skill of the workforce, direct their innovation to be more ecologically sensitive, adopt digitalization to fast pace innovation and create a diverse workforce towards an innovative culture.

Innovation is becoming the metaphor in capitalism today, an image that you start relating to hope and the future. The pandemic induced pause and the return is the opportunity for Indian companies to “Build Back Better”. It is time now to make investments in innovation, more importantly, in R&D more seriously. The world is racing ahead, and we have numerous instances around us of countries that have grown big on the back of innovations like South Korea, Taiwan, Vietnam, Singapore, etc. There are no limitations to what Indian companies can achieve on a global scale with the right mindset and game plan.

[1] https://www.wipo.int/edocs/pubdocs/en/wipo_pub_gii_2021.pdf

[2] https://economictimes.indiatimes.com/small-biz/sme-sector/net-zero-a-new-start-point-for-combating-climate-crisis/articleshow/85122978.cms?from=mdr

[3] https://iri.jrc.ec.europa.eu/scoreboard/2021-eu-industrial-rd-investment-scoreboard

[4] Page 238, Economic Survey 2020-21 Volume 1

[5] Page 283, Economic Survey 2020-21 Volume 1

The survey looks at R &D spend of corporates and that figure is dismal. I believe that the new India is being built by companies started less than a decade ago. If a similar survey is done among new companies, India is certain to fare well.