The pandemic accelerated the demand for ESG or sustainable investing which saw a significant growth in 2020. Amidst this rise, ESG mutual funds seem to be gaining popularity with almost all the major asset management companies in India having launched an ESG Mutual fund by end of 2020. For a deeper understanding of the portfolio constituents of the ESG mutual funds, I studied 6 of them – Kotak, Quantum, Axis, SBI, ICICI and Aditya Birla. The portfolio constituents for all these funds were sourced from the information available at moneycontrol.com.

I have mentioned below a few key trends that were revealed by my analysis:

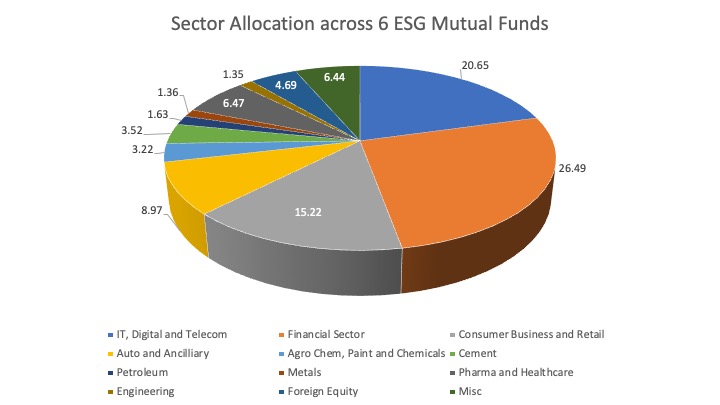

- Sector Allocation: It was very clear that 4 sectors – IT, Digital, Telecom and Financial sector, dominate in all the funds studied. These sectors contribute close to 50% of the funds. Consumer oriented business including retail are the next favorite, followed by Auto and then healthcare and Pharma. Although this spread can vary between the funds, but the average spread overall across these six funds revealed this trend (the overall % composition is depicted below).

There was a low exposure of the funds to companies from oil & gas sector and from metals and mining sector. Only 2 funds out of the 6 holds investment in metal companies and 4 in oil& gas and refinery sector. This is tending towards a safer route. While there is international investor pressure on fossil fuel, chemicals and metals will continue to be important in the future decades.

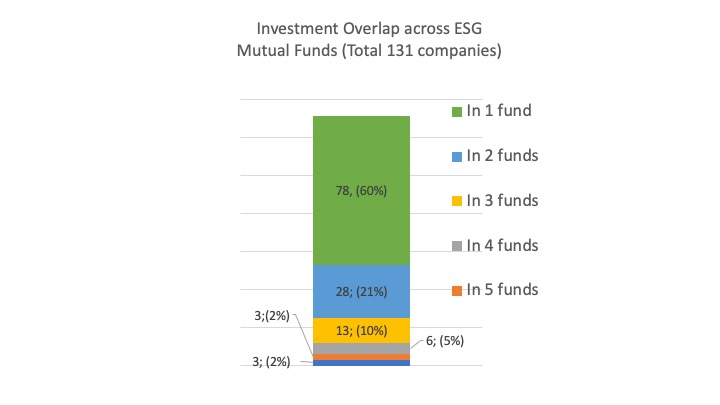

- Commonality of the companies across the ESG funds: There are a total of 131 Indian companies who find their position across the 6 funds. An analysis of these reveals that 81 of them find inclusion in only one of the funds. Which means almost 60% of the constituents are unique to a fund. In fact, only 3 companies are common to all 6 funds. While starting the study, I anticipated to find more constituents common among the ESG funds. This result might be an indication to the difference in methodologies that each fund uses to select the constituents. While some funds have stated that they use information from popular ESG ratings, but most of them have indicated that they have their own evaluation process. This disparity could not be attributed to a different sector orientation of funds as even within the same sector, different companies have been selected by the funds. While each fund will strive to be unique and owe their performance to their uniqueness, I expected more commonalities in the constituents mainly because the sector orientation is very similar across all these funds.

I am expecting that each of these funds have a good engagement with the invested companies and going forward, we will see more transparency on the methodologies. For companies, it should be their target to be part of these funds to showcase their ESG performance and for the funds. For the funds, they need to consider an investing approach that should go beyond playing safe to create more impact through these investments.

Note: The constituents can change in the funds. This analysis was done with the constituents in each fund as of first week of May 2021 as per information available at moneycontrol.com.

I totally agree with your view point of transparency on the methodologies in selecting the firms. ESG investing in India is at very nascent stage and it seems these fund houses have jumped on the ESG bandwagon hastily. I have observed that the firms in the funds are top performers of their respective sectors and ESG particularly is not the driver of their high performance. Even if we take the individual firm’s ESG ratings/performance out of the equation, they are still at top of the charts of any index (eg. Nifty). This might be coincidental, but it sounds too good to be true. There is a big question mark on the funds selection methodologies which should be disclosed by the fund managers.

This seems to be interesting and hope generated curiosity amongst corporates to make their disclosures more transparent and qualify to become a part of these. Ofcourse the transparency form the other side is also needed.