Co-authored with Sakshi Uberoi

ESG ratings are being increasingly considered in the investment screening process. This has come from the recognition that we need to adequately price the ESG risks and premiums associated with the business practices and conduct – surfacing the true market valuation of a business. A large reason for the surge in ESG investing is attributable to the data points that are emerging which reflect that the ESG portfolios are continuously outperforming the traditional ones. The boom in the ESG and sustainability themed investments has also spurred the boom in the ESG raters and scorers in the market. India too has seen new players enter this market.

One challenge that has been with the various ESG ratings has been the lack of consistency between the rating providers. Critics have called for standardization, but then each rating agency have their reasons and explanations as to why their score is different and fit for the objective they have set for the rating – fair point and we have also seen each rating finding their own set of user and followers.

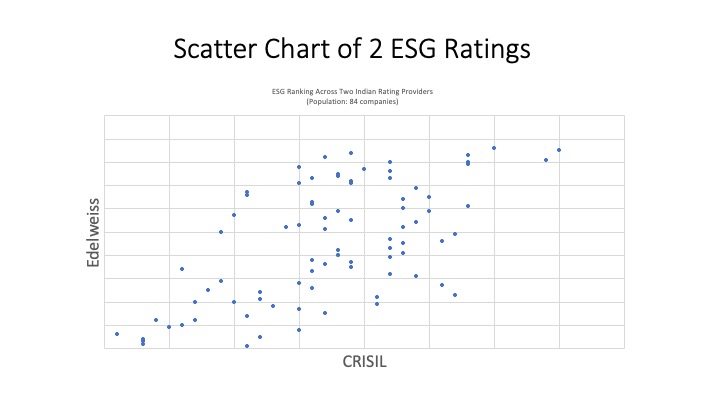

To delve deeper into the challenge of consistency in the ESG scores, we thought it might be interesting to do an analysis of the 2 ESG ratings which have come up in India. Recently, we saw Edelweiss publish the ESG scores of 100 Indian companies while, Crisil came out with their ESG scores for 225 Indian companies. There were a set of 84 companies that were common between them. We plotted the ranking of the common companies for both the ratings. Based on the scoring provided, we found that the overall rank of the companies differed between the two rating agencies. For example, as per Edelweiss, i.e., HCL Technologies (ESG score = 91.9) ranked no.1 while, based on Crisil score (67), it ranked 11 . Similarly, the top scorer in Crisil, Infosys (ESG score=79), ranked1 received a rank of 6 based on Edelweiss score (ESG score=89)

The scatter chart for the ranking across both ratings brings a correlation coefficient of 0.6. This would mean a moderate positive relationship between the ratings.

A deeper analysis will tell you that 20 companies out of this 84 have a ranking difference more than 50 and 23 companies where the difference is equal or less than 10. There is more alignment in some sectors than others. Between both ratings you will find clustering of companies in same sector. In both ratings the top ranking are all IT companies followed by financial institutions. Fossil fuel business, Alcohol, Pharma, Chemicals etc. are clustering on the lower side. This is also a reflection from the analysis done earlier around ESG mutual funds. ESG funds in India are dominated by IT and financial sector companies. This can potentially result in a sector skew on performance of these funds more than the ESG performance.

Looking at the methodologies, there are differences. The weightages across E, S and G are different. From the publications associated with the ratings, it is understood that Edelweiss has an almost equal weightage across all 3 dimensions, while Crisil has 35% weightage for E, 25% for S and 40% for G. Both ratings factor the transparency, the trend and benchmarks. They also moderate the scores using a negative regulatory challenge the company may have.

A key takeaway from the analysis of the 2 ratings is that the materiality lens needs to evolve further. For users of these ESG scores, a useful lens will be to consider a sectoral perspective with a view to identify ESG leaders and followers. We should see an improvement in the ESG scores as more companies are getting ready with better disclosures. The BRSR is also a significant move to improve the ESG disclosures. In the next couple of years, ESG disclosure will be a normal, it will be the performance that will make the difference. The ESG ratings becoming public is a significant reason in the rise of ESG discussions at the right levels of the company.

It’s interesting that you feel the BRSR will help improve disclosures. It adopts an approach very different from what global frameworks are aligning towards by adopting a very granular approach with minimal focus on the risk articulation. Who do you think will use the BRSR disclosures and other India based ratings to channelise their fund flows?

Actually Section A, Item 24 of BRSR requires company to do a detailed ESG Risk assessment including financial implication. I would say that this is the first of its kind. Yes there are some dimensions of BRSR that can improve. The BRSR disclosures if reported aligned to the guideline that is published will ensure a uniform approach to reporting. The comparability of ESG data will improve and hence can be used by any analyst.

A very good comparison. Could we also see some international comparisons ?

Nicely summarized, the biggest challenge in the Sustainability investment is lack of standardization, rating methodologies and governance standards. Additionally, education to the corporates and investors is another big challenge which the asset management firms needs to thing about..