Before we dive into the topic of Carbon Credits/Offsets, let us start with some recent news on the topic:

- Salesforce enters the Carbon-Credit business[1]

- London Stock Exchange Launches its Voluntary Carbon Market Rules[2]

- Lenovo CO2 Offset Services Surpasses 1 Million Metric Tonnes of Carbon Offsets Milestone[3]

- Macquarie’s Global Carbon invests in carbon offsets projects consultancy EP Carbon[4]

- Carbon credits used to offset carbon tax bill in Singapore must meet specific criteria[5]

- Indian plans its own carbon trading market[6]

- Gabon Carbon Credits Seen Fetching as Much as $35 a Ton[7]

- Thailand Launches First Carbon Credit Exchange to Curb Emissions[8]

- Australia’s first global carbon credits ETF hits the market[9]

- Microsoft announced plans to launch of Environmental Credit Service, targeting the voluntary carbon markets[10]

- Japan starts carbon credit trading trial to hit climate goal[11]

- Carbon credit surplus could soon turn into a shortage[12]

…………………………………

I am stopping at a dozen news articles, but trust me, there is much more.

So, what is happening? Why, as an organization, should you be bothered?

No company can reach a Net-Zero commitment without Carbon Offset. Zero is the hero when it comes to carbon offset. Every business will have to pay for the right to release GHG emissions in the coming future. This is a done deal by now, and that realization is stepping in, as seen from the market trends. The Voluntary Carbon Market (VCM) grew to around $1 billion in 2021, and estimates place the market for carbon credits could be worth upward of $50 billion in 2030[13].

While there are many reasons for this growth, a survey [14] threw up some interesting insights:

- 35% of company honchos attribute it to more corporate net-zero pledges

- 18% to the difficulty in cutting GHG emissions from corporate value chains

- 18% to demand from some compliance regimes that accept carbon offsets like the Carbon Offsetting and Reduction Scheme for International Aviation

- 12% to increased speculative activity

From experience, what you read till now should be enough to convince any organization that wants to sustain itself to take note and look at the carbon market seriously. If, as an organization, you are not working on your offset strategy, you will enter the game with a handicap, and there are no special privileges that you will get for the same.

Is Carbon Credit and Carbon Offset the same? Technically, no, but the terms are used interchangeably, and for this piece, I am using carbon credits instead of carbon offset credits, which will be used interchangeably. I will also not discuss whether offsetting is good or bad in this article. I recommend that every organization reduce their emissions to the maximum possible and only use good quality offset for the unavoidable residual emission. In one of my earlier articles, I explained what qualifies a good quality carbon credit[15].

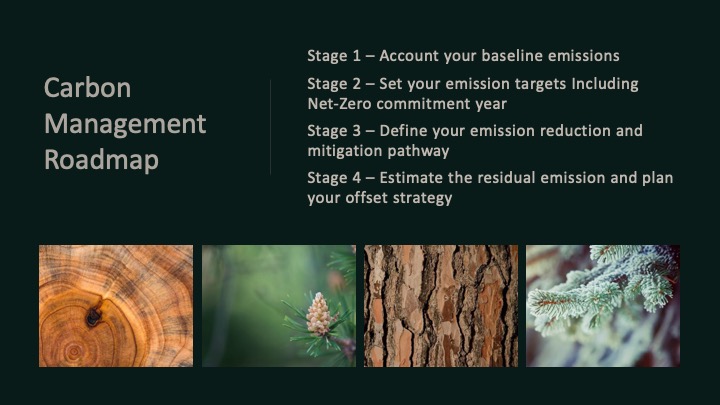

Enough of disclaimers and let us get back to the carbon offset strategy. As an organization, you should clearly know where you are. Take stock as to whether you have a transparent carbon accounting which covers the full scope and boundary of your emissions. Understanding the full scale of the organization’s emission baseline is essential. The second stage is target setting. For target setting, you should align to the 1.5oC Pathway and get your targets validated by the Science Based Targets Initiative (SBTi). Now there might be the question as to, without even knowing how to reduce the emissions, how can we set targets?

As a civilization, we have lost that opportunity or leisure. The race has already begun with high competition among peers, and if your targets do not align, you are making yourself a laggard. The third stage is to decide your mitigation pathways and quantum of mitigation. There are already clear pathways that are already available, like energy efficiency, renewable energy, circularity etc. But for achieving the targets you have set, there will still be gaps which require investments. Investments in technology, skills, research and infrastructure. Almost all these investments will be plausible if the organizations factor in the price of carbon. Once you have evaluated your options, you now need to estimate what will still be your residual carbon emissions. You now have the base information to look at the offset.

During the second stage itself, as an organization, you would have set a year for achieving Net-Zero. But it would help if you were not waiting for that exact year to source your offset. The planning process should have already started, and you should start applying the offsets at least five years ahead of your Net-Zero year. It will not be to the full quantum of the residual emissions but plan a steady increase year after year towards the Net-Zero year.

So, the year in which you need to apply the offsets is defined, and where will the offsets come from? There has to be a designed approach towards this. Many externalities define this approach. For Ex., in a country like Singapore, where there is already a Fixed-Price Credit-Based (FPCB) carbon tax system, where you can only use 5% of international offset credits, the approach is simple to follow the regulation. But I am sure that there will be an evolution of acceptance to global offset credit schemes in the coming years. The offset credits are issued both for the avoidance and removal of emissions.

The ideal route towards net zero will be opting for the removal offsets. But removal credits are scarce. Pure removal projects made up only 3% of all projects issuing credits over 2021 and 2022 YTD, while projects that include a mix of removals and reductions represented 13%. No credits were issued in 2021 for durable removals, the only type of offset that can effectively cancel the impacts of carbon dioxide released into the atmosphere in a functional reversal of emitting carbon dioxide[16]. I am hopeful that in future this trend will change and we will have more credits from removal of emissions.

An organization can design their project and get those projects registered against globally accepted standards. It is also possible for organizations to invest in an already registered project and accrue the credits. Spot purchase is always an option, while there is also the potential for future trading for organizations. While at present, future trading should be navigated with appropriate diligence to avoid risk, the relatively low-risk option is to invest in already registered projects. I recommend hedging across various options rather than putting all eggs into a single basket.

The quality of the offset credits is an important feature. The best option is to go with Certified Emission Reduction credits (CER) under the UNFCCC or Voluntary Emission Reduction credits (VER) registered with some of the most recognizable standards like Verra or Gold standard. While looking at the quality, please also consider the vintage of the credits. Although we are currently seeing organizations retiring credits with an average vintage of around five years, I recommend not going beyond three years and even limiting it to 2 years.

Carbon offsets are moving beyond buying complacency, political apathy and self-satisfaction, or guilty conscience appeasement. It is moving as recognition of business externality that has to be internalized. With the right strategy of mitigation to the best possible limits followed by offsetting the unavoidable residual emissions with good quality permanent removal projects, organizations can determine the future of the carbon markets in the right direction. Speaking in the manner of classical economics — the quantity and quality of the demand will determine the supply.

[1]https://www.wsj.com/articles/salesforce-enters-the-carbon-credit-business-11663675202

[2]https://www.londonstockexchange.com/raise-finance/equity/voluntary-carbon-market?wvideo=6asms4iqms

[3]https://news.lenovo.com/pressroom/press-releases/co2-offset-services-surpasses-1-million-metric-tonnes-sustainability-practices/

[4]https://www.businesswire.com/news/home/20221006005016/en/Macquarie’s-Global-Carbon-invests-in-carbon-offsets-projects-consultancy-EP-Carbon

[5]https://www.straitstimes.com/singapore/environment/carbon-credits-used-to-offset-carbon-tax-bill-in-singapore-must-meet-certain-criteria-nea

[6]https://economictimes.indiatimes.com/industry/renewables/india-plans-own-uniform-carbon-trading-market/articleshow/91082527.cms

[7]https://www.bloomberg.com/news/articles/2022-10-14/gabon-carbon-credits-seen-fetching-as-much-as-35-a-ton

[8]https://www.bloomberg.com/news/articles/2022-09-21/thailand-launches-first-carbon-credit-exchange-to-curb-emissions

[9]https://www.financialstandard.com.au/news/australia-s-first-global-carbon-credits-etf-hits-market-179797076

[10]https://cloudblogs.microsoft.com/industry-blog/sustainability/2022/10/12/driving-innovation-for-esg-progress-with-microsoft-cloud-for-sustainability/

[11]https://www.energyvoice.com/renewables-energy-transition/448180/japan-starts-carbon-credit-trading-trial-to-hit-climate-goal/

[12]https://ninepoint.com/media/620776/wsj-carbon-credit-shortage-sep27-22.pdf

[13]https://www.mckinsey.com/capabilities/sustainability/our-insights/a-blueprint-for-scaling-voluntary-carbon-markets-to-meet-the-climate-challenge

[14]https://cleanenergynews.ihsmarkit.com/research-analysis/recordhigh-price-forecasts-across-global-carbon-markets-and-st.html

[15]https://santhoshjayaram.com/time-for-india-to-be-ready-with-quality-carbon-creds/

[16]https://www.carbon-direct.com/insights/assessing-the-state-of-the-voluntary-carbon-market-in-2022

Good post.