Last year I started this analysis and I continue to use the S&P ESG Score[1] for this analysis. The reason I select the S&P ESG Score is because it publishes the ESG scores of 97 companies of the NSE 100[2]. Compared to 2020, at the time I am doing this analysis, the NSE 100 have a 10% churn, which means that 10 companies have changed in the list of companies I analyzed in 2020.

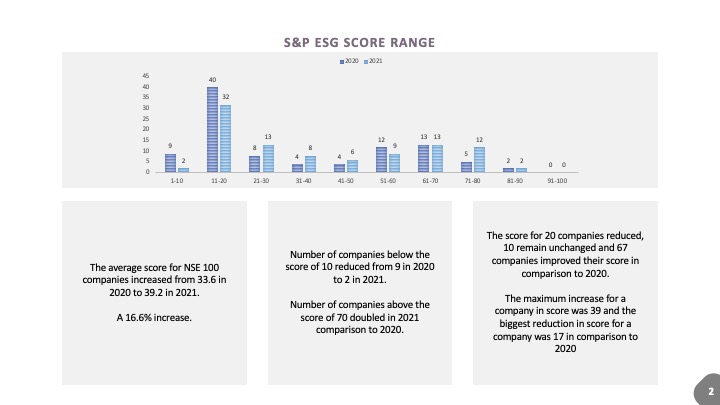

The first cut analysis brings out that there has been an overall increase in the average score of the NSE 100 companies. Compared to the last year average of 33.6, this year the average stands at 39.2. That would be an increase of 16.6 %. The improvement is a steady increase over the last 2 years. As compared to 2019, the average increased by almost 30%. With the increased discussion on ESG and more focus from the boards of the companies, we should continue to see this steady increase in years to come.

The highest score among the NSE companies is 85 and the lowest is 6 out of a maximum possible 100. When you look at the spread of companies across the score range, you find that the number of companies who scored below 10 has reduced from 9 companies in 2020 to 2 companies in 2021. You can see a similar trend on the higher scores as well. The number of companies above the score of 70 doubled in 2021. In 2020 when 7 companies scored above 70, this year we have 14 companies. This is a sharp increase at the top of the table because even in 2019, we had only 7 companies above the score of 70. 67 companies improved their score as compared to 2020. The scores of 10 companies remain the same and for 20 companies, the score has reduced.

The NSE 100 has a dominance of companies from Financial Services, followed by Consumer Goods. We have 23 companies from Financial Services, 15 from Consumer goods, 10 from Pharma, 9 from Metals, 7 each from Oil & Gas and Automobiles, 6 from IT, 5 from Cement and rest spread across various sectors. When you look at the average score across sectors IT tops with an average score 68, followed by Cement at 67. It is a clear reflection of the position these sectors represent India in the world forum. Both the companies above the score of 80 are IT companies. The sector clearly is the flag bearer of ESG and can be benchmark with the global best. The Cement sector of India has always been much ahead of global averages when it comes to efficiencies and productivity.

As ESG regulations around the financial sector is developing across the world, I will not be surprised to see the sector improving their scores in coming years sharply. I would expect the same for sectors operating globally, for example, Pharma.

[1] https://www.spglobal.com/esg/solutions/data-intelligence-esg-scores

[2] https://www1.nseindia.com/products/content/equities/indices/nifty_100.htm

A very crisp and to the point analysis sir. Scores of fertilizer and pesticides companies, and automobile industries is also a very positive sign.

The impact of such efforts will be significant towards attaining SDG 2030 targets.

Worthwhile to mention that such efforts are closely monitored in capital markets and directly or indirectly pushing companies for adopting a sustainable business model. Hope this continues.

Apart from high score of service industry what is gratifying to see id achievement by Cement Industry. How does this compare with say Fortune 500 or some other indices. Great work and keep on being Agent to push the National Achievement.

A very crisp and to the point analysis. As you rightly mentioned Pharma sector operating globally need to improve their score in ESG performance.