ESG seems to have caught the attention across all professionals. So, what is this mojo around ESG? Read on…

A question that is commonly asked these days: What is the difference between ESG and Sustainability? Some might say they are two sides of the same coin, while I have also seen people say sustainability is the approach, whereas ESG is the measurement. Many connect sustainability with only the E part of ESG, which I feel is the narrow definition of sustainability. It is not the first time that different terminologies have been used in similar contexts. Corporate Social Responsibility and then later Corporate Responsibility and even Corporate Citizenship have all been used interchangeably.

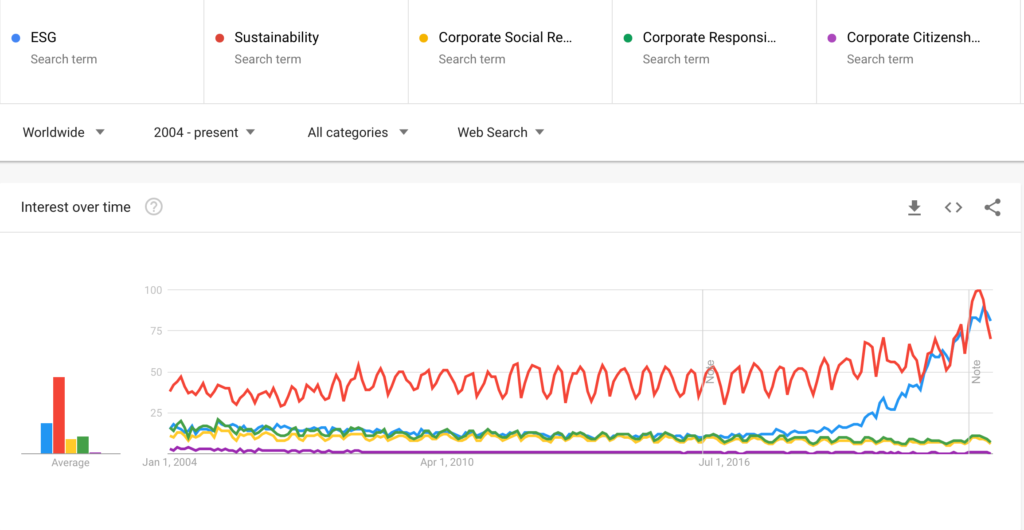

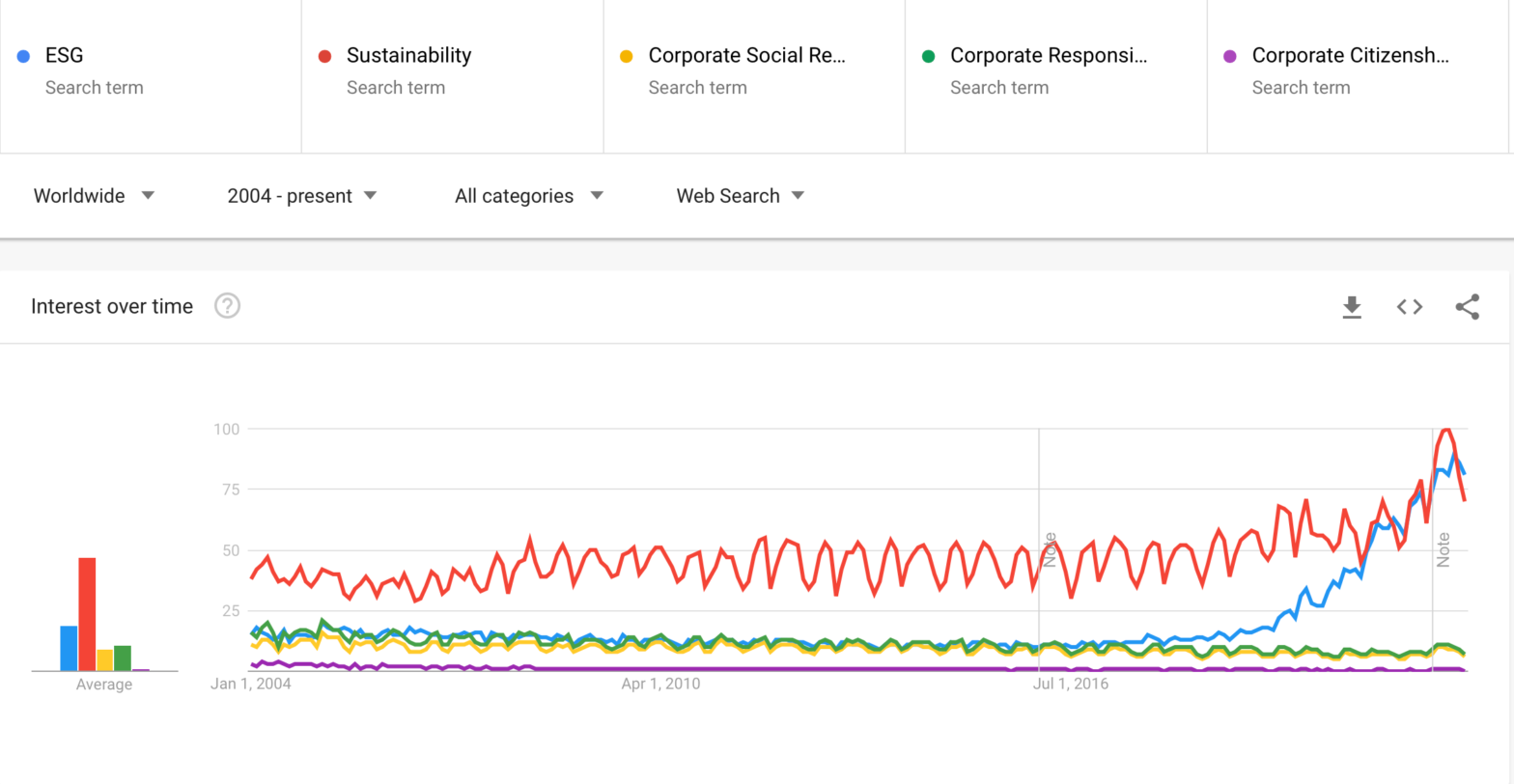

Let us start by analyzing how these terminologies fared over time, and for that, I used Google trends. As can be seen from the Google trends graph shown below, it plots all these terms as interest over time on web searches. To clarify, interest over time, which is the plotted, represents search interest relative to the highest point on the chart worldwide and time. A value of 100 is the peak popularity for the term. A value of 50 means that the term is half as popular. A score of 0 means there was not enough data for this term. So it is a way of normalized trend data. This means that when we look at search interest over time for a topic, we look at that interest as a proportion of all searches on all topics on Google at that time and location.

While there has been a steady decline in the usage of terms like Corporate Social Responsibility, Corporate Responsibility and Corporate Citizenship, the three letters “ESG” has suddenly caught the fancy of multiple stakeholders in recent times. From mid-2018, the term has rocketed. It is also at the same timeline; we see the term sustainability moving significantly beyond the 50 mark and, in March – April 2022, peak at 100. Sustainability as a word was among the peak popular words in web searches.

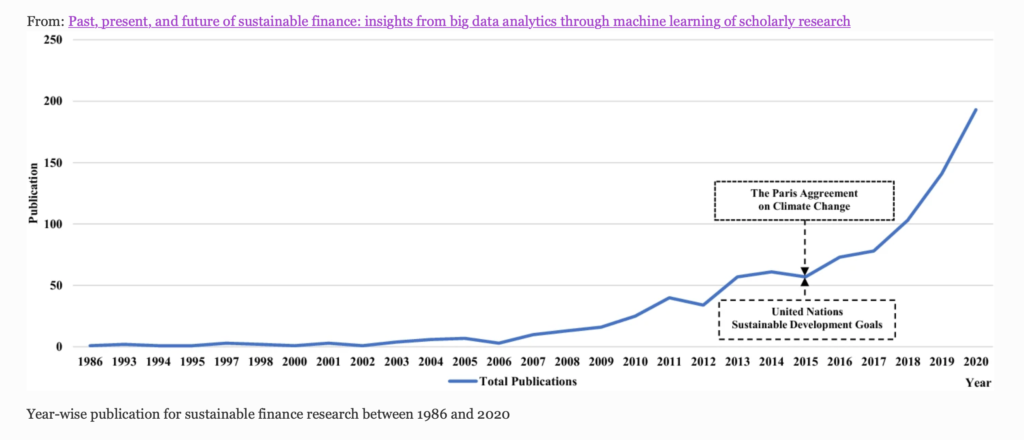

What caused the sudden movement of the term ESG might give us some clue as to answering our question. The summer of 2018 was historical but is now beaten by the summer of 2022. The heat waves of 2018 and the wildfires showed climate change as a visible and destructive force. While it would have been a wake-up call, what followed later strengthened the momentum. In Jan 2019, we had the first business milestone when PG&E filed for bankruptcy. It became the first major corporate casualty of climate change. Then the pandemic hit and showcased what a global catastrophe could be like. At least for the pandemic, there was the hope of vaccination, but for climate change, there are no vaccinations. All this led to the realization that capital is at risk, and the call to build back better together led to financial stakeholders taking action. We all know what happens when money starts chasing something. The number of research publications on sustainable finance can be a proxy for this interest; the below graph can be a good indication[1].

This trend also pushed the change in the definition of the purpose of the corporation by the business roundtable in 2019. This is significant because the business roundtable constitutes some of the most powerful corporations, and it changed Milton Friedman’s 1970 dictum that the only social responsibility of a business is to increase its profits. But that still does not answer specifically why the ESG term rose. For that, we will have to examine the history of how these terms evolved.

Corporate Social Responsibility (CSR) was officially coined in 1953 by American economist Howard Bowen in his publication Social Responsibilities of the Businessman. But over the years, the term moved into a space of philanthropy and charity, and corporate responsibility and Corporate Citizenship were derivatives of CSR.

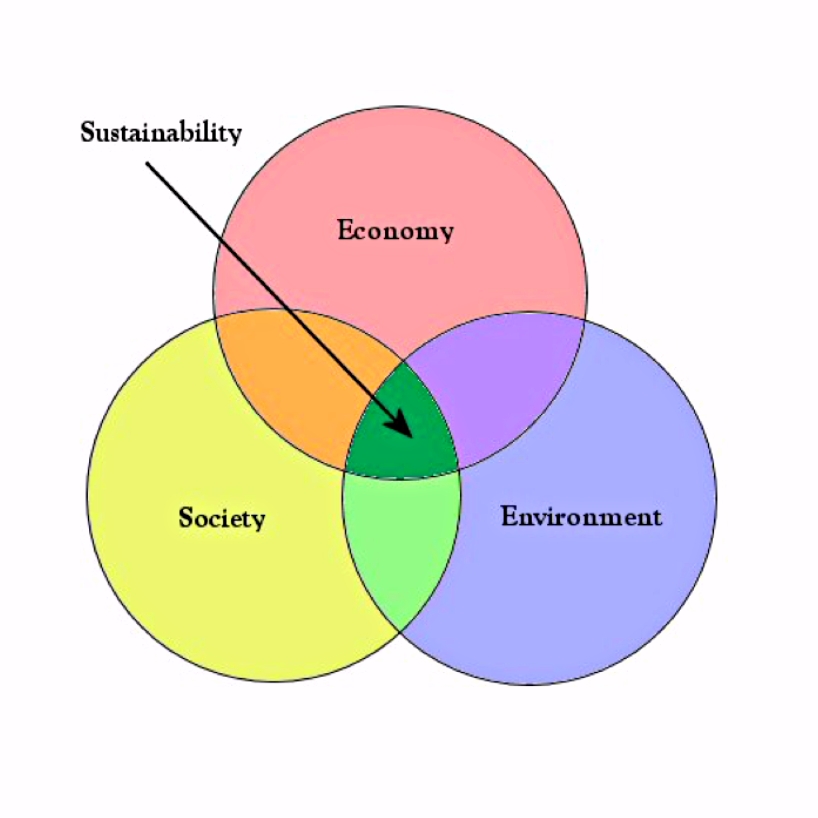

The origins of the word sustainability in the current context can be traced to the 1972 publication “The Limits to Growth” from the Club of Rome. This is important because data and modeling gave us indications of the finite nature of the planet. The sustainable development definition that we are familiar with today, “Development that meets the needs of the present without compromising the ability of future generations to meet their own needs,” was first seen in the 1987 United Nations Brundtland Report. Around the same time, the famous Venn diagram model of the sustainable development concept with intertwined three circles appears. This diagram has various versions but was first employed by economist Edward Barbier (1987)[2]. The Rio Earth Summit in 1992 consolidated the principle of “sustainable development” by gaining a consensus from world leaders.

One of the versions of the sustainable development Venn diagram

In the ’90s, a sub-concept arose in the business literature called “Triple Bottom Line” (TBL). It is a way of accounting for the business’s needs to operate, first coined in 1994 by John Elkington and later explained in his book “Cannibals with Forks” (1997). In 1995 a derivative called “People Planet Profit”, also known as the triple bottom line (TBL), also came up through John, and Shell used it in one of their reports. TBL was also the basis of several reporting standards, including the Global Reporting Initiative (GRI).

The term ESG, representing Environmental, Social and Governance, was first coined in 2005 in a landmark study (or initiative) titled “Who Cares Wins” (WCW). It was initiated by the UN Secretary-General and UN Global Compact in 2004 in collaboration with the Swiss government. WCW was endorsed by 23 financial institutions collectively representing more than US$6 trillion in assets at that time. IFC and the World Bank Group were among the endorsing institutions. The initiative produced several publications:

Publications of the Who Cares Wins Initiative:

• 2004 – Connecting Financial Markets to a Changing World

• 2005 – Investing for Long-Term Value

• 2006 – Communicating ESG Value Drivers and the Company-Investor Interface

• 2007– New Frontiers in Emerging Markets Investment

• 2008 – Future Proof? Embedding ESG issues in Investment Markets

From the publications, we can understand ESG as integration of environmental, social and governance (ESG) factors into investment processes and decision-making. Although the term ESG has been in use within the investment circles, its rise started in 2018 when the risk from ESG started impacting investments. The now famous letter of 2018 from Larry Fink validates it. Post-2018 so-called ESG investments continue to increase, and once it got linked to access to capital in a big way, the term marched into the board rooms.

Now, knowing the history of the terms, what is the difference between ESG and Sustainability? Or rather, is there a difference?

Going by the origins, if the scientific study of Limits of Growth is the genesis, sustainability needs to be more scientific. It needs to connect what we do to the planetary boundaries. But with the introduction of TBL, it moves into an accounting exercise and more so with ESG. In that context, there is no comparison. What can be compared is TBL vs. ESG.

At first look, even ESG looks to be a derivative of TBL, but why was economics replaced with governance? I think that is where the difference is. For investment decision-making, the economics of the investment was always the prime factor, and ESG became a layer to mitigate emerging risk. This risk perspective creates a one-dimensional view of outside-in impacts (financial materiality). In the original TBL concept, economics was a balancing act along with environmental and social dimensions to create sustainable development. It had an organization’s inside-out and outside-in perspective while deciding what is material. Tweak to economics is required for a sustainable future. Undoubtedly, the three dimensions of ESG will create good economics, but that will require mainstreaming it. ESG cannot remain as a factor or a product inside the investing circles; it has to be integral to all investments.

I am not complaining because ESG has caught the interest and imagination of people from all dimensions of business, whereas, in the past, sustainability as a term failed to get that. But the connection to the sustainability of the human race on this planet needs to be made, and it should not remain a risk-oriented, metric-driven accounting exercise. So, in conclusion, for me, it is a realization – “Ekam Sat Vipra Bahuda Vadanti”. This verse from Rig Veda tells us that the absolute truth is only one, but it manifests in different forms (or there are many pathways to it). The truth is that we as human race have created an imbalance in the only home we reside and our own survival is on the edge. The efforts to address the same is taking different forms and pathways. Whatever pathway we take, we should not miss the real outcome we want to achieve.

[1]https://link.springer.com/article/10.1007/s10479-021-04410-8

[2]https://www.researchgate.net/publication/320312167_The_Sustainable_Development_Goals_and_the_systems_approach_to_sustainability

This is really insightful. The origins and key nuances of sustainability and ESG have been brilliantly articulated.

This is wonderful explanation. Very insightful and addresses one of the key questions of the recent time. Thanks for the brilliant description on the topic from the origin to adulthood.

Very well explained for ESG Origin Pathway.

Very well articulated about ESG

Beautiful read.

What a great piece! Thanks for a well articulated and insightful article reaffirming the fact that the difference in terminology rarely matters, it’s the larger objective that counts.

Very insightful and well explained with facts and context.

Very well researched and articulated