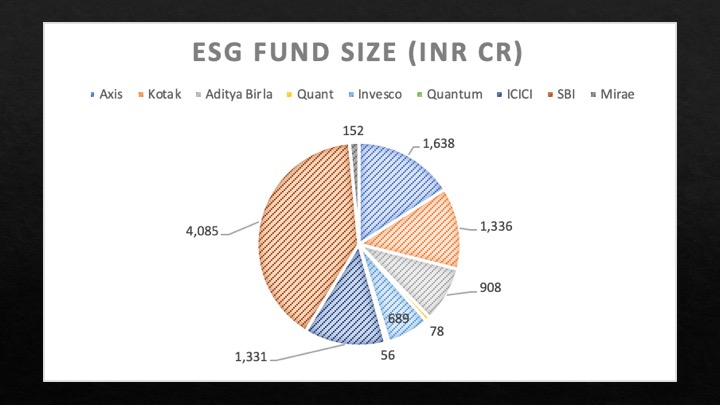

Couple of weeks back when I posted about the size of the ESG funds in India[1], there were some enquiries regarding where these funds are investing. So, in continuity to an analysis I did in January 2022[2], I gathered data to present the below analysis. The analysis is done on the same 9 funds as in January 2022. Overall fund size has reduced by 17% in August 2022 compared to January 2022. The AUM under these 9 funds now total to around 10,300 crore as compared to INR 12400 crore in January 2022.

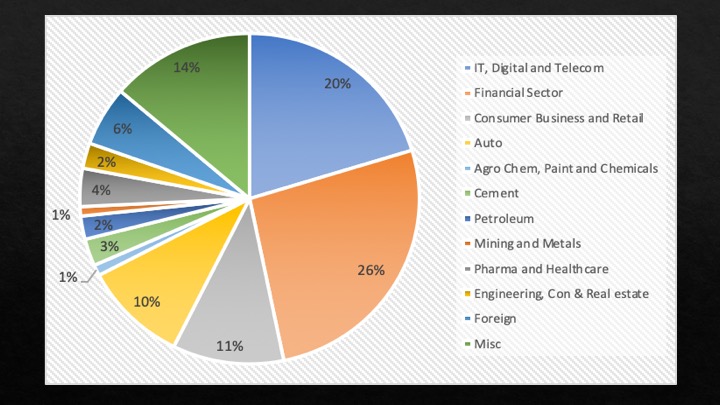

There is no change in the sectors these investments make. The Financial Services leads the pack along with IT, Tech & Software. Together they cover 46% of all investments by these funds and this does not include the foreign investments made by these funds. Around half of the ESG investments are into these 2 sectors. There is also no change in the following 3 sectors, which are Consumer Business & Retail, Auto and Pharma & Healthcare. Chemicals, Mining and Petroleum continues to be the lowest investments by these ESG funds.

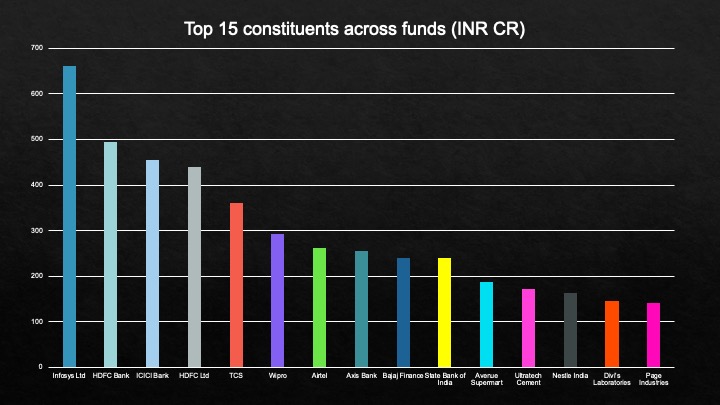

The top 15 companies constitute almost 44% of the investments across these funds. The leaders in the pack being Infosys and HDFC Bank. Compared to January 2022, HDFC moved from 3rd to 2nd position. Almost every financial sector companies in top 15 improved their position compared to January 2022. Axis bank moved from 15th position to 8th position, SBI moved from 14th position to 10th position, ICICI from 7th to 3rdposition etc. A preference to the financial services can be seen in the past 8 months.

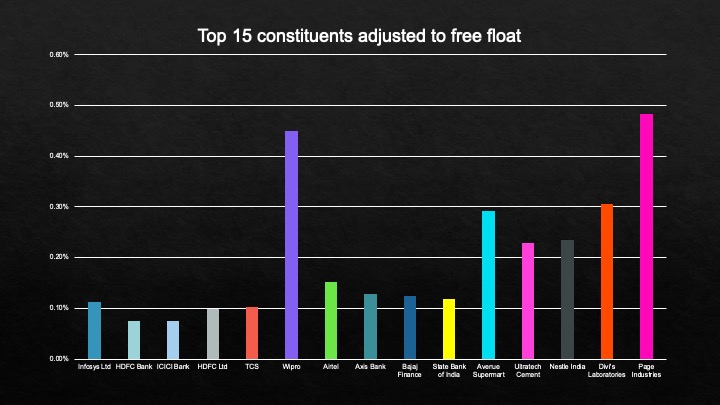

This time, I thought of extending the analysis to see what % are these investments as a ratio to free float of these companies. That gives a very different perspective. Page Industries and Wipro are the leaders when you do the free float adjustment, followed by Divi’s laboratories, Avenue Supermart, Nestle India followed by Ultratech cement. Although the % of investments against the free float is still low, I feel it is an important way to look at the investments through that lens.

If the investments remain focused on comparatively easy sectors, the overall impact of ESG to drive sustainable business will remain that elusive goal. The transformation required is in those sectors termed hard to abate sectors and there has to be incentives and drivers in those sectors to make the desired change and that too in an unprecedent pace. Without an impact focus by these funds, the real value of these investments will be very limited.

Note: The constituents can change in these funds. This analysis was done with the constituents in each fund as of first week of August 2022 as per information available at moneycontrol.com.

[1] https://www.linkedin.com/posts/santhosh-jayaram-145270b_esgfunds-mutualfund-esgetf-activity-6960808344198529024-7kpc?utm_source=linkedin_share&utm_medium=member_desktop_web

[2] https://santhoshjayaram.com/where-are-the-indian-esg-funds-investing/

THANKS

Super analytics Santhosh ! Very insightful .. looking forward to hearing about each fund performance vs Nifty 50 (or you gave earlier), comparative performance of funds would also be interesting to see !